Inflation Overheating Has Fully Arrived

Some of the costs and harms of inflation explained; also the causes of the current round

Not sure how many subscribers know me or care to know that I've been out-of-action in sending out these newsletters since the end of April for a very good reason. In early May we took on the role of foster parents for a nine-year-old boy who requires almost all of our attention. Never having parented before, it's been quite an education, but all of that is a topic for a different type of newsletter. Now, I have a few hours to pound out an update covering these past 15 weeks in the state of the economic recovery from the COVID crash.

First, in regard to Friday's (un)employment report, Wowwee! Here are Marketwatch.com's intro paragraphs:

The July U.S. jobs report on Friday showed the economy added 943,000 jobs last month, with the unemployment rate falling to 5.4% from 5.9%.

Economists polled by the Wall Street Journal had expected a gain of 845,000 jobs and an unemployment rate of 5.7%.

Furthermore, June's figures were revised upward to the extent that in the last two months we've gained a net 1.88 million new jobs. The gains in July were concentrated in government agencies including public schools, plus restaurants, hotels, and other providers of leisure and entertainment; but the gains extended into every sector, save one, tracked by the Bureau of Labor Statistics:

Here is the unemployment rate:

A couple of points about this second graph: First, the graph errs in labeling all of February '20 to present as the recessionary period. You may have heard less than three weeks ago that the recession was declared to have officially ended in April 2020. The National Bureau of Economic Research, a private entity that stakes the only claim to being the recognized arbiters of the timing of business cycles, made the call on July 19 that the recession was over in April just two months after its February onset. That's a record for brevity matched by the record severity of the downturn, as is evident in the unemployment spike visible above. I'm not taking the time to go back and find the exact date of my prediction, but I claim credit for nailing in one of these newsletters that April marked the bottom of the recession and the beginning of the recovery.

Second, the current 5.4% unemployment approaches the level that throughout the '90s and '00s—when I was teaching high-school macroeconomics and following the current thinking closely—was considered to be "full employment" or the "non-accelerating-inflation rate of unemployment" (NAIRU). The fact that the 2019 baseline shown at the left of the graph is so much lower down in the low '3's reflects the go-go supply-side-led conditions of the Trump boom. Those conditions are not now repeatable in today's demand-side-led conditions that are much more prone to inflation. What I'm saying is that just two years ago, we were in a sweeter spot than we can expect to be possible in the current regime: any continued moves toward economic growth will continue to push inflation higher or cause it to "accelerate," unlike previously when we could have unemployment down to about 3% without hitting the point of accelerating inflation.

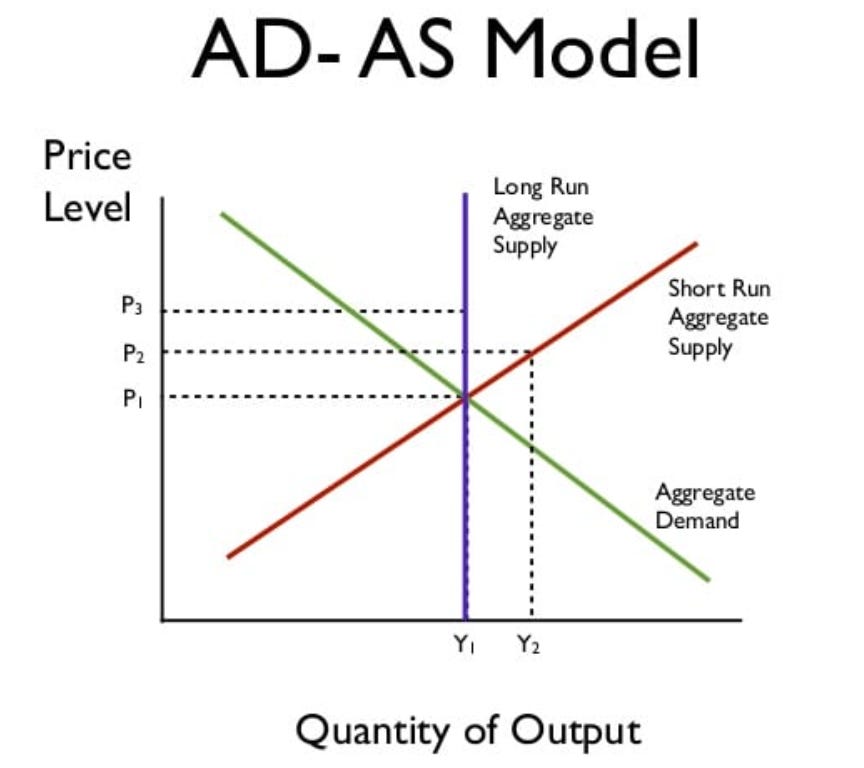

The explanation uses the most elementary bit of theory [which gives an excellent reason for everyone to take the Advanced Placement macroeconomics course or its equivalent—starting with everyone elected to national office]. The essential graph is this one:

When Aggregate Demand is pushed to the right by a combination of "free money" being handed out to 70% of U.S. households plus the creation by the Federal Reserve of vast amounts of new money in the banking system, the green line moves to the right, and the price level rises. That's now. But when deregulatory policies and pro-producer tax policies are put in place in 2017-19, the red line also moves to the right, which negates or neutralizes the tendency toward higher prices. Furthermore, those policies also move the blue line to the right; that line and the Y1 point on the horizontal axis can also be labeled as "potential output" or "the full-employment level of GDP." Pushing that toward Y2 means that we can create more jobs for more people and create more societal wealth without having it spill over into higher inflation.

But as I say, now we are lacking the policies that tend to increase aggregate supply; in 2021 it's all a matter of pumping up aggregate demand through the one-two punch of the Fed's "printing" of money and the elected branches' handing it out. Inflation is inevitable and entirely predictable.

Which is why I started predicting (and noticing the first signs of) accelerating inflation in each of my January 2020 newsletters. By February it was a major theme here in NO-BAH-DI-NOZ. By spring it was a major theme in the news media, and by summer it was the major worry of the general public.

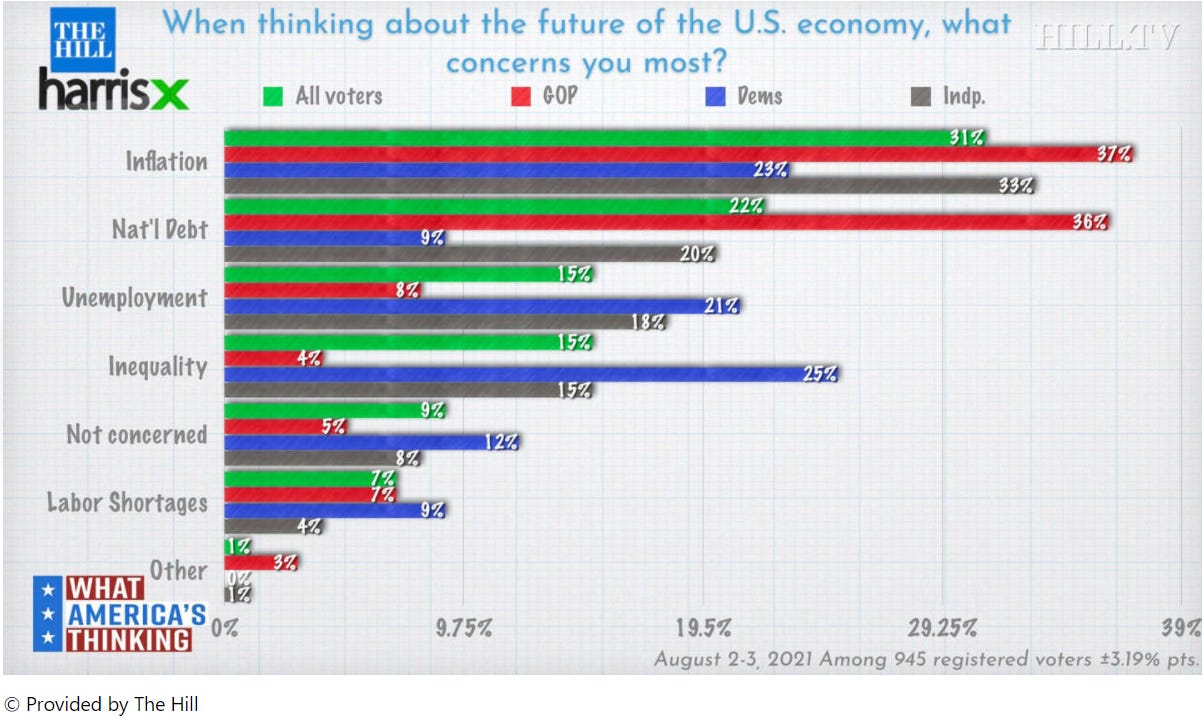

From MSN.com: "Poll: Inflation named as top economic concern for voters"

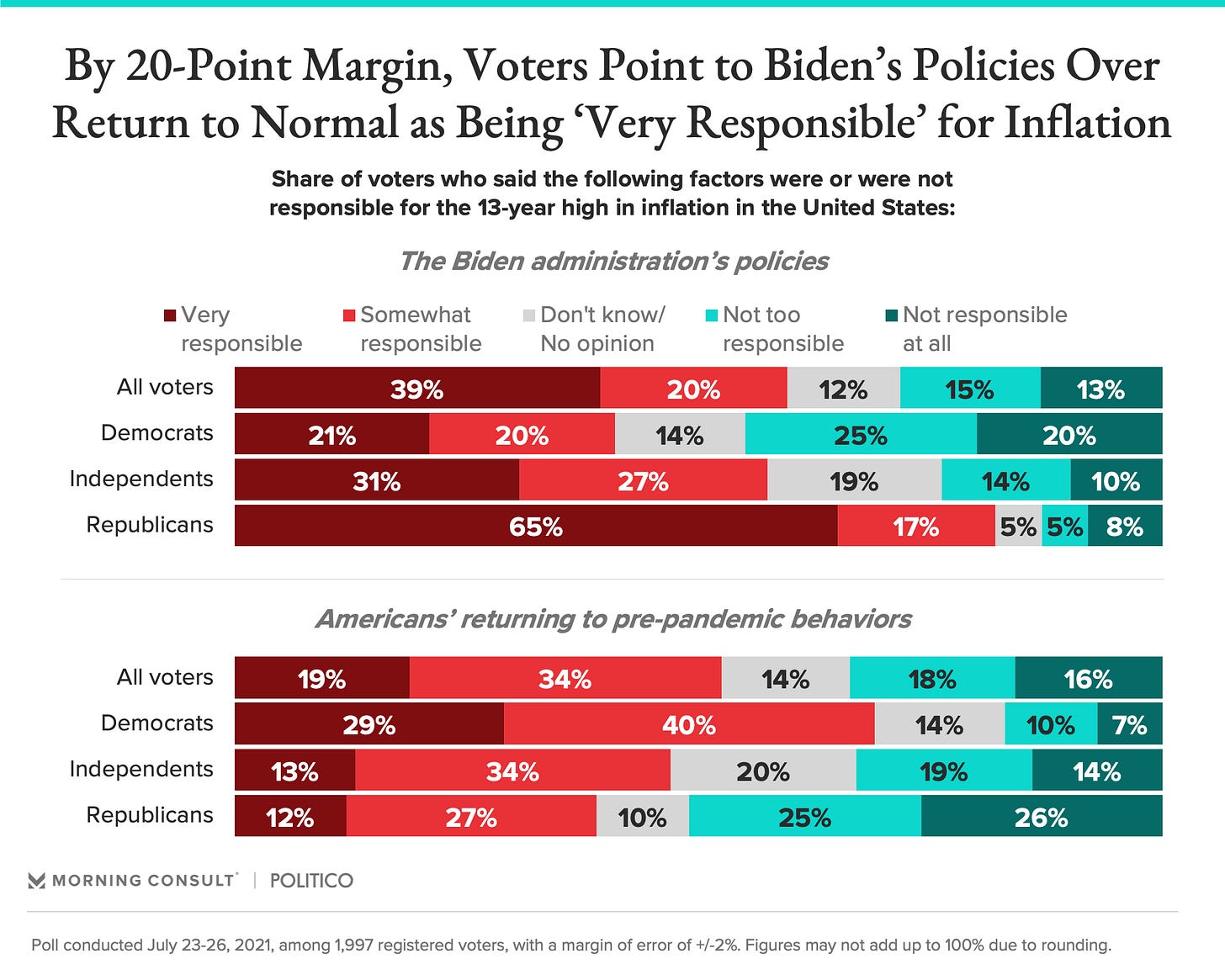

Furthermore, this subtitle and graphs from morningconsult.com, July 28: "More blame from voters for rising costs is placed on the president’s policies than a return to pre-pandemic life"

The graph immediately above mentions "the 13-year high in inflation in the United States." Specifically, here are the numbers from the official Consumer Price Index used to calculate cost-of-living adjustments to Social Security benefits and a host of union contracts and other wages and prices. The headline and excerpt are from CNBC.com's most recent monthly report on the Labor Department's data:

"Inflation climbs higher than expected in June as price index rises 5.4%"

Stripping out volatile food and energy prices, the core CPI rose 4.5%, the sharpest move for that measure since September 1991 and well above the estimate of 3.8%. …

“What this really shows is inflation pressures remain more acute than appreciated and are going to be with us for a longer period,” said Sarah House, senior economist for Wells Fargo’s corporate and investment bank. “We are seeing areas where there’s going to be ongoing inflation pressure even after we get past some of those acute price hikes in a handful of sectors.”

A separate report from the Labor Department’s Bureau of Labor Statistics noted that the big monthly hike in consumer prices translated into negative real wages for workers. Real average hourly earnings fell 0.5% for the month, as a 0.3% increase in average hourly earnings was more than negated by the CPI increase.

Even when inflation is generated mostly by the fact that people who have more "free money" are freely spending it, which would ordinarily be taken as a sign of at least superficially good news ~ even then, the public sees inflation as negative, giving rise to this headline from Yahoo! accompanied by the article's gloomiest paragraph:

The Financial Related Stress Index continued to trend negative, however. The index rose by another 2.1%, going from 61.9 last month to 63.2 this month. A reading over 50.0 equals more financial stress while a reading below 50.0 on this index would indicate consumers feel less stress. This index was last below 50.0 in February 2020 (48.1).

You may be wondering, so what? If So-so Security and union contracts and the like are all indexed to inflation, then everything keeps up, right? And no one is really hurt by rising prices, right? Again, we're back to a major topic of my HS teaching of AP econ. There are lots of other costs of inflation, not the least of which is the sense—already evident in the polling I've cited here presently—that inflation encourages a sense that conditions are out of control, and it's our governmental leaders' fault, and everything is going off the rails. That's not a recipe for calm and deliberate policy-making nor for rational decision-making on the part of consumers.

Another cost, an extremely serious one, is that inflation discourages savings and punishes savers, as if we need any more of that when interest rates on savings and bonds have already been zero-point-nothin' for far too long. Savers and savings are the lifeblood of the long-term growth/health of the economy, so discouraging/punishing them is, as I say, extremely serious.

And another is the fact that not everything is indexed to inflation. Some people really are on a fixed income with no way to keep up when the prices of everything rise.

Actually, my own situation is a case in point. Although my Illinois teachers' pension will have some sort of cost-of-living adjustment (COLA) built into its formula, that will only kick in when I start drawing income from the pension [or maybe later, when I reach the age of full, not early, retirement—I should really know what the rule is, but I haven't checked or have forgotten]. The point is that nothing in my COLA formula keeps me up with the 5.4% of inflation I've suffered from July '20 to June '21. Of course the same will be true for the X % of inflation I'll endure over the next 12 months, and then the following year and beyond. If we were to have 5.4% inflation for 3 years running, that would already compound to 17% stripped out of my real (i.e. inflation-adjusted) future income.

With four+ years to go before reaching full retirement age, 5.4% compounds to about 28% between now and then. Plus there's all the other years since 2014 when I last contributed to my pension, but luckily for me inflation during those years was very low, just a little above 1% most of the time. Still, I'm looking at around an 11% erosion in the real value of my pension before the 5.4% recorded for these past 12 months, and before the 28% that I have penciled in for the next four+ unknowable years.

Just going with those numbers, that's something like a 46% hit I'll be taking. To the extent that the income stream from my pension represents my family's standard of living in retirement—a quite substantial extent—that means we would be living on about 54 cents on the dollar, compared to what it felt like the pension was set up to be worth back in 2014.

More relevantly, compared to what I would have expected if Trump-era low inflation had been sustained from 2015 to retirement—namely, let's say a Trumpish 1.5% compounded over 11+ years = about an 18% erosion of the pension's real value—it looks like the inflation of the 2020s could cost me about 46 - 18 = 28 percentage points of my standard of living in retirement, up in smoke. Of course, any greater inflation than 5.4% would leave me worse off than that, and any lower reduces the pain.

The obvious point is that for people in my position or those otherwise on a fixed or semi-fixed income, inflation is a wealth tax. Not a metaphor, not an analogy. Some politicians propose a wealth tax, but the truth is we already have one, albeit one that is unevenly and unjustly applied. Specifically, inflation is a tax levied on savings held in cash or other modest, accessible, middle-class, prudent assets. Avoidance of this tax takes the form of speculation in things like crypto-currencies (the more proper term for which should be 'digital assets') and the sort of nonsense we see from the Reddit/Robin Hood crowd.

Inflation also causes the idle diversion of societal resources into assets of little true value, such as contemporary art created by relatives of politicians and summer homes in tony zip codes, in the thought that these might hold their value while the modest and prudent yet socially productive assets whither on the vine and lose 46% over 11 years. That's what happens when inflation averages only 3.5% annually:

… and that's the magnitude of wealth tax that I'm looking at hitting my family before retirement.

Similarly, inflation also reduces the real value of your wage/salary income—not just your saved wealth. Flash back to my string of headlines in this newsletter to be reminded that June's "big monthly hike in consumer prices translated into negative real wages for workers. Real average hourly earnings fell 0.5% for the month, as a 0.3% increase in average hourly earnings was more than negated by the CPI increase." If your raise since last summer was less than 5.4%, your "raise" has been negative, too, and you are poorer in income now than you were in the first summer of COVID. That's certainly the case for me by a pretty big margin.

I have my doubts about how many people really understand the math at work here, and particularly the power of exponential compounding; but even if many don't, the polls cited above indicate that the public does have a sense that inflation is a pernicious, destabilizing, and impoverishing thing. They also seem to believe that overly stimulative policies—both monetary from the Fed and fiscal from the elected branches of government—are to blame. And they are right.

p.s. We went to an Asian supermarket in Boston this weekend for the first time in 19 months. My wife reports that prices there had risen 15-30% across the board on every type of product. She is hyper-aware of prices, and I made sure she was precise with her calculations. Because the comparison goes back to before anyone had heard of COVID, it's an apples-to-apples comparison that is not skewed by any 2020 pandemic distortion. At the end of July, I also received a report from a Main-Street furniture and hardware retailer in Montana with this brief update: "Yowza prices are going UP! Cost of goods and freight increases galore!"

As educational outreach people at the Federal Reserve Bank of Chicago used to tell me, "Some of the best information we get is anecdotal. When we find that the anecdotal information is not matching with our officially-gathered statistics, we go back and try to find what is wrong with the latter."