First-quarter Economy Is Strong and Getting Stronger

Without help in the form of another inflationary and misdirected stimulus package of Free Money (check out the many corroborating links inside!)

Sorry that a crush of work at my day job occupied most of the hours I was awake the last two+ weeks, including the last two weekends. I couldn't even think of turning to this project. Now there are three weeks of new data since my Valentine's Day newsletter, and many topics. But after a brief look at the big picture, this week I turn mostly to the dangers of an overstimulated round of inflation and the latest massive spending package being enacted now. You’ll see that those two are very closely interconnected.

The best way to present the bird's eye view of where we think we are in the economy is by showing the Federal Reserve Bank of Atlanta's GDPNow 'nowcast' for the present Jan-Mar quarter's rate of growth of Gross Domestic Product. That, of course, is the standard broad measure of the output of the economy. We regard around 2.5 - 3% as the typical, good, hopefully sustainable rate of GDP growth, always expressed at an annualized rate. Here's the picture:

I think it's especially important right now to emphasize that GDPNow is a mechanical, data-driven exercise. As each day's indicators of parts of the economy come out, such as one month's retail sales, or one week's claims for unemployment insurance, those numbers are fed into the mathematical model, which then spits back it's best calculated guess as to what the current quarter's GDP growth rate will be when it is announce in the last week of April. What a nowcast does not do is take into account intangibles like the perceived likelihood of legislation being passed in Congress and signed into law. I speek, of course, of the latest (5th) coronavirus relief bill, the $1.9tr we hear about every day. The gyrations in the olive-colored line in the graph do not reflect anything about that bill or anything going on in the government.

The brief summary of the olive line is that from late Jan to Feb 10 it looked like Jan-Mar economic growth would fall in the range of 4.5 - 6%. Then on Feb 17, the Fed fed the most recent data at that time into their equations, resulting in a huge upshift to 9.5% growth. In six subsequent revisions, the nowcast has fluctuated between 10.0% and the present 8.4%. The very last revision this morning Mar 8 was upward a tick from last week.

The even briefer summary is that the economy is humming along at a high rate of improvement, and even moreso over the last three weeks. If you missed the good (un)employment news of Friday the 5th, I briefly offer these two complementary summaries from CNBC:

Job growth surges in February on hiring jump in restaurants and bars

https://www.cnbc.com/2021/03/05/where-the-jobs-are-february-2021-chart.html

The video embedded in the top story has a title of "U.S. added 379,000 jobs in February, vs 210,000 estimate." The pull-quote from the text seems to me to be this:

“Today’s jobs report sets an extremely positive tone as we move into warmer months and the pace of COVID-19 vaccinations accelerates,” said Tony Bedikian, head of global markets at Citizens Bank. “While the labor market still has a lot of ground to make up, we are in a different place than we were a year ago and the economy seems poised for a strong rebound.”

One factor making matters even better than the numbers appear to be is this: The net +379,000 jobs would have been 61,000 higher than that, but for a loss of that many construction jobs. Those are surely due to the crazy snowstorms of February, which were unseasonable in many of the places hardest hit. So the March employment report will show all of those jobs coming back, plus whatever net new construction job growth occurs, plus a great many COVID re-opening jobs in other sectors. March is going to be huge, is what I'm saying.

Oddly, the nearly simultaneous release of jobs information from the payroll processing firm ADP came out the other way: Private payrolls grow disappointing 117,000. As a sort of tiebreaker, the Bureau of Labor Statistics' "civilian employment" number from same survey of households that gives us the unemployment rate (down to 6.2%) shows a net +208,000 jobs in February. Taken all together, and recognizing that for complex technical reasons economists as well as journalists focus most of their attention on the establishment survey that gives us the +379K headline, I refer you back to that pull quote about "an extremely positive tone."

I end this section with an article I found while doing my last edit of this newsletter, one day late, published this morning Mar 8: Goldman Sachs forecasts a jobs boom, says unemployment rate could fall to 4.1% by the end of 2021

Regular readers will know that I devoted considerable ink in several newsletters of Jan and Feb writing of the likelihood of inflation. I expect to write more again next weekend (or soon thereafter) about my contention that our statistical agencies haven't been measuring inflation accurately. This week I want to explain the scenario that has people like me on alert for inflation.

Inflation accelerates for a combination of reasons stemming from both the demand-pull side (M2 money supply up 25% in a year, households are sitting on trillions of recently accumulated savings and soon to be let loose to go out and spend, with the government adding trillions of of new spending on top, GDP growing at about 3X its usual top-sustainable rate of 3% or so) and from the cost-push side (policies that constrict the energy supply, others that raise labor costs, and lingering supply-chain disruptions left over from COVID and related lockdowns [my house under construction will have taken about a year longer than advertised, and will probably have removed all profit to the builder, given the price locked in on the Purchase and Sale Agreement in December 2019—which requires the builder to squeeze even higher prices out of the next project to try to make up for it, on top of the rising prices for supplies and labor]).

All of this this is already happening, and before the states reopen fully. Federal Reserve Board Chairman Jerome Powell has boxed himself in, by telling Congress, the public, and the financial markets that he will keep interest rates at zero and asset purchases at full blast for quite a while. So, when inflation rises sooner and more sharply than he even now expects, he and the Fed haves a real dilemma that is very concerning. If they don't react with higher interest rates, they allow and facilitate the demand-pull inflationary surge to continue and accelerate. That could lead to a harsher but later clampdown with higher rates then. See the 1970s, leading to the Volcker rate rises of 1979 and the two recessions of 1980 and '81-82. On the other hand, if Powell reverses his current stance sooner, i.e., starts raising interest rates earlier than what he's been promising, the financial markets will react very badly. Federal debt and corporate debt is now so high that if—nay, when—there is a material rise in rates, there will be bankruptcies and defaults, and the Fed—nay, we all—will have a major issue. The stock market (which is never the most important thing) would also take either scenario badly, I think. Right now with rates at ultra-low levels, P/E ratios are at a too high level, and speculation is excessive. If we get inflation and high rates then the P/E multiples fall, and we can get a major correction which has the potential to be very bad as we get the combo of falling P/E plus falling earnings. That would be ugly. That is why Senate Majority Leader Schumer saying that Modern Monetary Theory means there is no reason to worry about deficits, and Powell saying M2 is not a major problem could combine over time to become a financial crisis as they are proven wrong. [Copyright alert: Some of this long paragraph is derived from a private newsletter I receive.]

The entire scenario above only deals with the ramifications of dealing with inflation and interest rates, without even describing the effects of inflation per se—the arbitrary redistributions, menu costs, devastation of those on fixed incomes, and most of all: the punishment of savings and savers who fuel the long-run growth of the whole system.

I have to think that if I could get a few drinks in Powell, he would spill the beans to the effect that, For G-d's sake, don't pass the $1,900,000,000,000 excess inflationary spending package. Extend the unemployment insurance top-off a while longer, provide a third Free-Money payment only for those earning in the bottom half of the income distribution, fund the vaccine distribution, get the schools in places like Massachusetts open like they have been for some time in places like Arizona; then stand back as everything else reopens. Let me (Powell) handle the already treacherous balancing act of timing the next interest rate increase without fueling the risks of inflation that will make that task so much more painful.

This is the article to read next, going deeper into the subject of inflationary overstimulation: https://www.mauldineconomics.com/frontlinethoughts/overstimulation-risk

Pay special attention to this part, with ideas from a Washington Post op-ed by the former World Bank / Treasury / Clinton / Harvard / Obama luminary Larry Summers:

Government and central bank policy should aim to keep the economy running roughly in line with its potential: not too hot, not too cold.

Larry Summers noted the Biden relief package will inject around $150 billion per month, while CBO says the monthly gap between actual and potential GDP is now around $50 billion, and will decline to $20 billion a month by year-end (because it assumes the COVID-19 virus and all its variants will be under control).

The point: We're running a major risk of going squarely into the "too hot" zone. Every time I open a browser I find more evidence. Here's the one from the current minute:

Investors haven’t fully grasped inflation is ‘dead ahead,’ economist Mark Zandi warns. The pull-quote:

“We’ve got the pandemic winding down, a boatload of fiscal support coming and we’ve got a lot of folks who have pent up demand and a lot of savings that they’re going to unleash,” Zandi noted. “Growth is going to be very, very strong – lots of jobs, falling unemployment [and] wage growth.”

Further background to what Summers was talking about a few inches above is available here: https://www.brookings.edu/blog/up-front/2021/02/22/what-is-potential-gdp-and-why-is-it-so-controversial-right-now/

A package of about 1/3 of $1.9 trillion would have been much more closely calibrated to the appropriate amount of money to spend now, for the good of the economy at large. And that also happens to be just about the amount needed to do the worthwhile parts (identified in the Powell thought bubble above) of the $1.9tr bill, which will be fully enacted this week.

With reference to the $1.9tr, on our official state media outlet, Lulu Garcia-Navarro said on NPR's Weekend Edition with (Sun Mar 7, 8 a.m. in my market) in the very first sentence of the morning's broadcast:

There is ONE thing you CAN say about the massive coronavirus bill that passed in the Senate yesterday: It is aimed SQUARELY at millions of broke and anxious Americans.

You can hear it for yourself here.

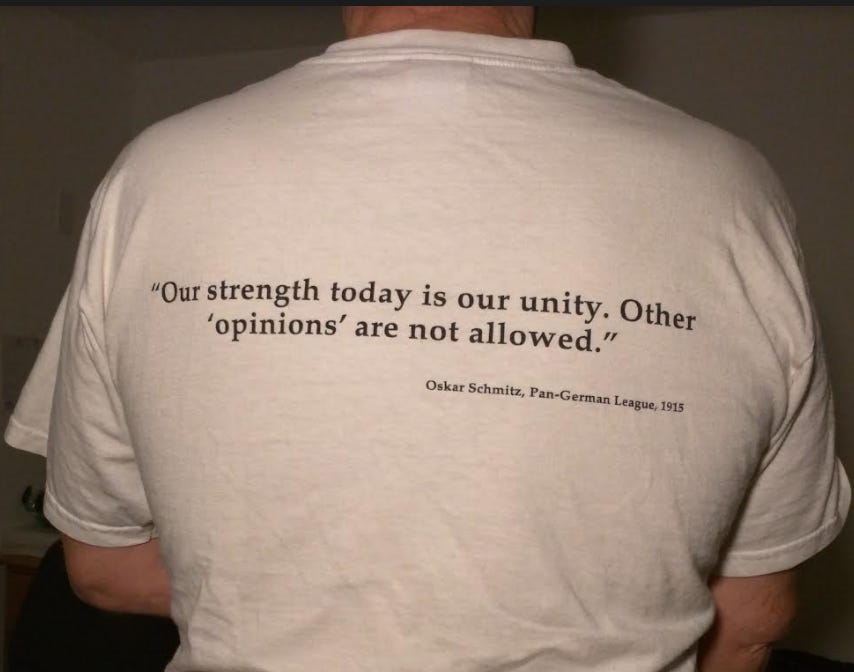

You could think this contention is highly arguable. But it's worse than that, given that her point was that that her assertion about the bill's aim was not arguable (because it's the ONE thing you CAN say, without fear of contradiction by NPR). In beginning the thought by dismissing the possibility of there being another side or any valid dissent, even before stating the ONE thing we are being told to believe, I'd have to say this makes the leap from highly arguable to blatantly biased. It sounds and reads like a press release from one political party, not the lead sentence in a news story, or even a news analysis story. If you're not listening to NPR, that's the quality of reporting that you're missing.

If your only sources of information are state media like this and you don't know what "other side" I could possibly be referring to, here is one articulation of the argument that the $1.9tr is poorly and only partially aimed the right way. If you add up all the dollar amounts listed in this article's third through sixth paragraphs (on categories that are most likely to be COVID-related purposes), it comes to $1,084,900,000,000. That's only 57% or 4/7 of the total. What are the other 3/7 or $815,1000,000,000 being spent on? Some of it could be the unemployment benefits mentioned in fourth paragraph, which might not be attached to a dollar amount (the writing is ambiguous, making it impossible to tell).

Then again, some of the 1.0849tr that I called "likely to be COVID-related" is not a cinch for being fully justifiable. Consider the $300b (or $350b according to this other source) going to state and local governments at a time when their revenues are holding "virtually flat" (New York Times, March 1: "Virus Did Not Bring Financial Rout That Many States Feared"). "Moody’s Analytics used a different method and found that 31 states now had enough cash to fully absorb the economic stress of the pandemic recession on their own." Consider, too, that the previous four COVID relief bills (Mar 6, Mar 18, Mar 27, Dec 27) have already sent $310 billion to states and localities. Another source finds that only about $6 to $16 billion would be needed to make state government budgets whole. In this week's bill they are getting $195.3b instead, or somewhere between 12X and 32X what they need.

If we don't all get massive tax refunds from our overfunded state governments in the next year or so, I'll never know why not. More likely the states will spend every dollar they get, and then in 2022 complain about having to make 'cuts' from the over-stuffed 2021 baselines, go hat in hand to the Biden administration, and get even more a year from now.

That same NYTimes article includes another revealing graphic I'm glad I found:

Is there any interpretation of this other than the idea that the extra $1.9tr on top of the other four COVID bills is completely over the top?

About my idea, above, of further limiting eligibility for the Free Money payments, I'll only say that nobody earning what I do—or more, up to $150-160K for joint filers (= about 2.6X higher than the median household income of ~60K), or even somewhat less—should be made into a ward of the state. Is that a ridiculous thing to say? Let me be clear: Stop sending Free Money to me and people richer than me!

And here's a third question for you: What do you suppose scores of millions of comfortable middle-class people will be doing with their next Free Money payment ~ and all the ones to follow after that if my Senator gets his way? Evidence is hot off the presses on Monday morning Mar 8 tells us: Young people looking to spend almost half of their stimulus checks on stocks. Thus further pumping up the speculative bubble that is in itself a form of inflation (i.e., in asset prices); we see it too in housing prices, cryptocurrencies, NFTs, etc., etc.

But remember, the ONE thought you are supposed to or CAN have about the $1,900,000,000,000 is that it is aimed SQUARELY at the broke and anxious.